Actual patterns

Patterns are graphical models which are formed in the chart by the price. According to one of the technical analysis postulates, history (price movement) repeats itself. It means that the price movements are often similar in the same situations which makes it possible to predict the further development of the situation with a high probability.

Actual Patterns

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

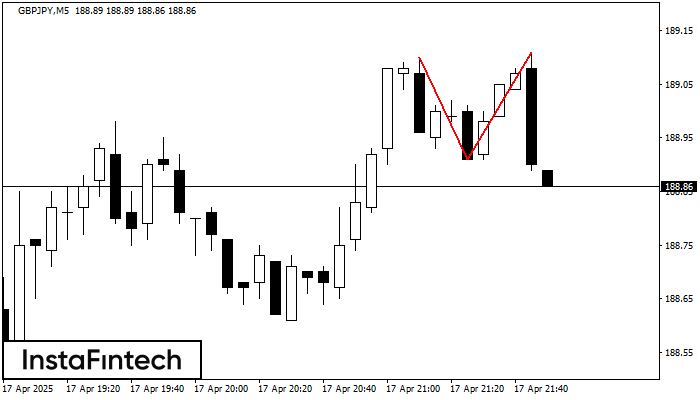

The Double Top reversal pattern has been formed on GBPJPY M5. Characteristics: the upper boundary 189.10; the lower boundary 188.91; the width of the pattern is 20 points. Sell trades

The M5 and M15 time frames may have more false entry points.

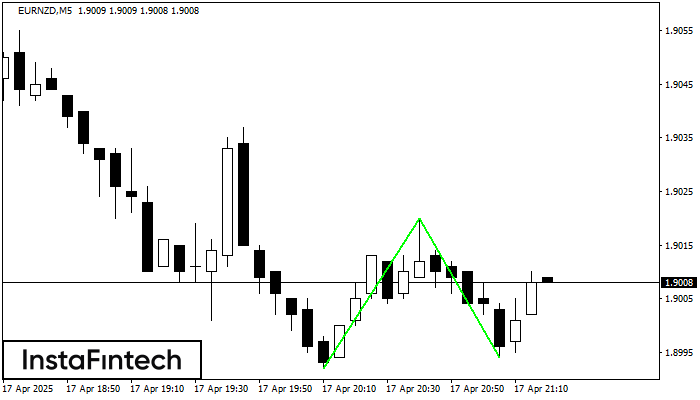

Open chart in a new windowThe Double Bottom pattern has been formed on EURNZD M5. Characteristics: the support level 1.8992; the resistance level 1.9020; the width of the pattern 28 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Double Top reversal pattern has been formed on #NTDOY M15. Characteristics: the upper boundary 18.07; the lower boundary 17.31; the width of the pattern is 78 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowThe Bullish pennant pattern is formed on the AUDJPY M15 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowAccording to the chart of M5, #PEP formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 142.99 and 142.53 are the coordinates

The M5 and M15 time frames may have more false entry points.

Open chart in a new windowAccording to the chart of M5, #PEP formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 142.53/142.73 whereas the upper border goes across 142.99/142.73

The M5 and M15 time frames may have more false entry points.

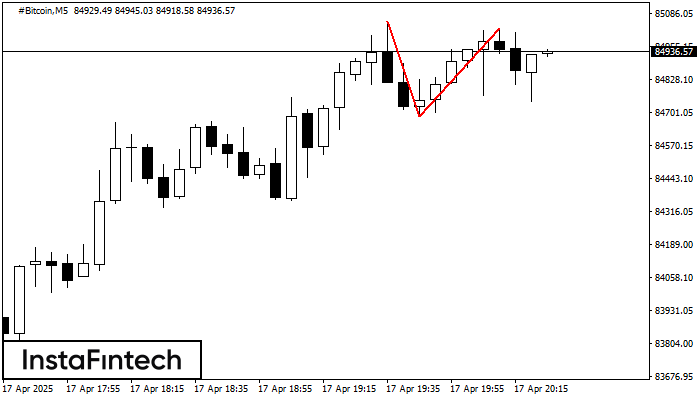

Open chart in a new windowThe Double Top reversal pattern has been formed on #Bitcoin M5. Characteristics: the upper boundary 85053.67; the lower boundary 84685.87; the width of the pattern is 33901 points. Sell trades

The M5 and M15 time frames may have more false entry points.

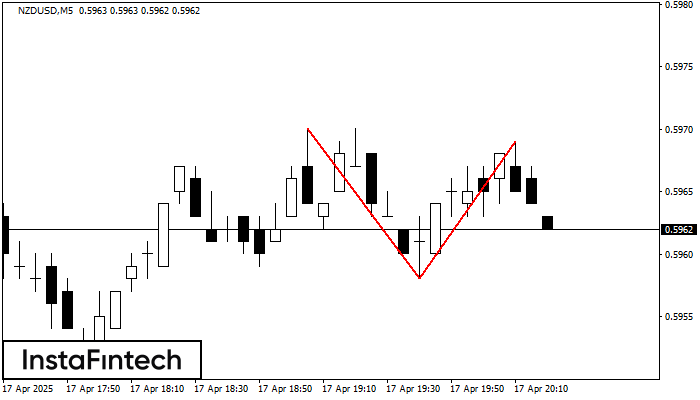

Open chart in a new windowThe Double Top reversal pattern has been formed on NZDUSD M5. Characteristics: the upper boundary 0.5970; the lower boundary 0.5958; the width of the pattern is 11 points. Sell trades

The M5 and M15 time frames may have more false entry points.

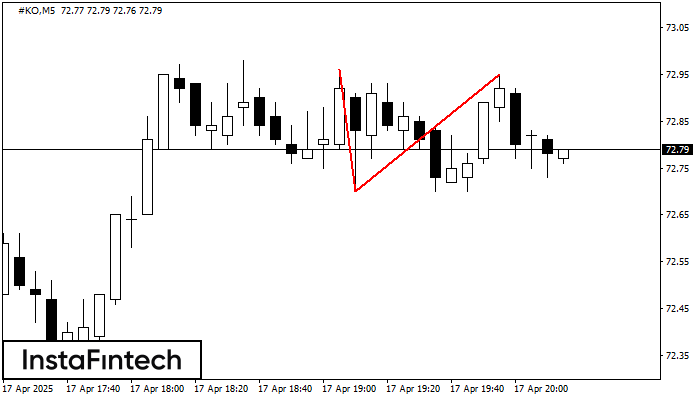

Open chart in a new windowOn the chart of #KO M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 72.95; the lower boundary 72.70; the width of the pattern 25 points

The M5 and M15 time frames may have more false entry points.

Open chart in a new window