The EUR/USD currency pair began Monday with a sharp drop from the opening. Interestingly, this time, the fall of the US dollar wasn't triggered by the American president. Any specific event didn't prompt it. The market stood still for a week and then seemed to conclude that no de-escalation of the global trade war should be expected in the near future. Perhaps insider reports, which continue to flow steadily into the press, played a role.

We've said before that trade relations and potential deals with the European Union and China are key for the dollar, the US economy, and Donald Trump. Trade turnover with these regions is measured in hundreds of billions of dollars—hence their significance. A deal with, say, Serbia is of no interest to anyone. So even if Trump announces he's reached an agreement with Lesotho, it won't save the US dollar.

And what's going on with trade negotiations with China and the EU? Trump has repeatedly said negotiations are underway but has avoided any specifics. From the president's comments, it's impossible to determine who is negotiating with whom. What if no negotiations are taking place at all? For instance, Politico recently reported that there are no talks with China. The reasons for this lack of contact aren't even the point. Perhaps Trump wants Xi Jinping to personally come to the White House and beg for a deal on American terms. Or perhaps China doesn't want to make the first move. In any case—does it matter?

It's also worth noting that Trump's official statements are regularly contradicted. During his first term, the statistics agency YouGov calculated that the American president made about 15 false claims a day. With numbers like that, it's not hard to disprove every other statement. Therefore, we believe there are no trade negotiations with China. And if that's the case, no trade deal should be expected anytime soon. Beijing has taken a very wise approach. They understand the trade confrontation will hurt their economy, but China no longer depends solely on exports. What's more, if Beijing gives in once to Washington, what's to stop the US from demanding an even more favorable (to themselves) deal in a few years? This could continue indefinitely.

Beijing's position is clear: We are open to negotiations but will not beg. The market seems to understand that Trump's promises of a "bright future" and ongoing negotiations should be taken with a grain of salt—if not a whole spoonful. As a result, there's little faith in Trump's words, and the dollar keeps plunging—even though the US president hasn't announced any new sanctions lately.

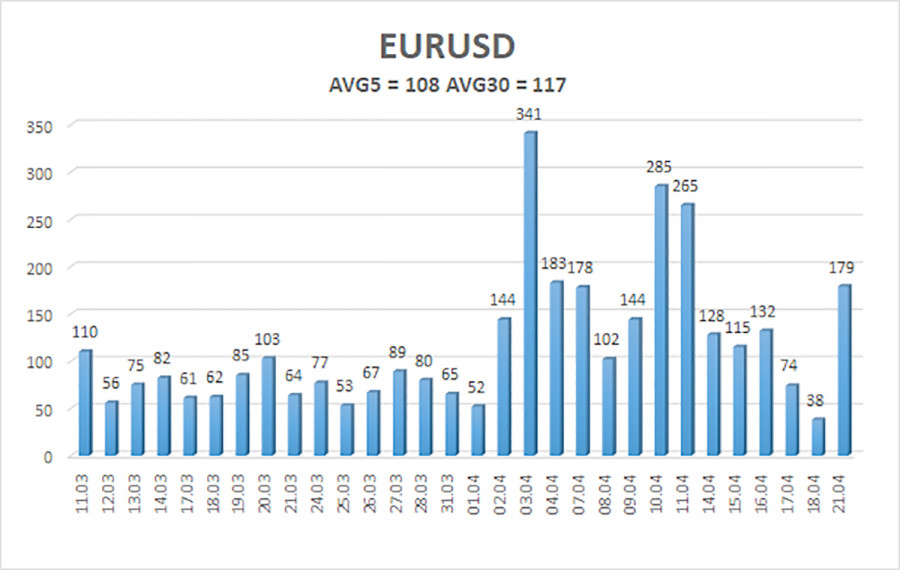

The average volatility of the EUR/USD pair over the last five trading days, as of April 22, stands at 108 pips, which is considered "high." We expect the pair to move from 1.1396 and 1.1612 on Tuesday. The long-term regression channel is directed upward, indicating a short-term bullish trend. The CCI indicator has twice entered the overbought zone, but the resulting correction was weak and has already ended.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1230

S3 – 1.0986

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1963

R3 – 1.2207

Trading Recommendations:

The EUR/USD pair maintains a bullish trend. For months, we've stated that from a medium-term perspective, we expect the euro to fall—but so far, nothing has changed. The dollar, apart from Donald Trump, still has no reason for a sustained rebound. And that single factor alone continues to drag the dollar deeper into the abyss. Moreover, it's increasingly unclear what impact that factor will have on the broader economy. It may turn out that by the time Trump calms down, the US economy will be in a dire state—making a dollar recovery unlikely.

If you're trading based on "pure" technicals or the "Trump factor," then long positions remain viable above the moving average, targeting 1.1612 and 1.1719.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.