The EUR/USD currency pair rose by a total of 110 pips on Monday and gained an additional 60 pips before the start of the U.S. trading session on Tuesday. The upward trend of the euro shows no signs of stopping, raising the question: what exactly is happening in the forex market?

Let's recall that in the early weeks of Trump's presidency, the market consistently favored the dollar. Traders responded positively to Trump's decisions to impose tariffs on imports from various countries, establish a Bitcoin reserve, withdraw from the WHO, NATO, and the UN, and shift the responsibility of supporting Ukraine onto Europe. Trump also expressed a desire to be a peacemaker, end the war in Ukraine, and was open to negotiating with Vladimir Putin. The market responded favorably to these announcements, if not with unanimous dollar buying, then certainly with a sense of optimism.

However, after a month and a half, the dollar is plummeting. Why is this happening, and what does the market think about the next four years under Trump? First, it's important to note that peace between Ukraine and Russia would benefit the entire world. The specific terms of such an agreement are a separate matter for politicians and world leaders to decide. However, if Trump is a peacemaker, why is the dollar falling?

The reason is that the market remains far more focused on economic factors. And what have we seen in this area? Trump is simply imposing tariffs on everyone and everything in sight. Since the U.S. has long imported far more than it exports, retaliatory tariffs benefit America. If the opposing side accepts Trump's terms, it's a win; if they don't, tariffs are imposed—and that's also a win. But if that's the case, why is the dollar falling, the stock market declining, and the crypto sector collapsing?

From our perspective, there are two main reasons. First, many investors and traders do not trust Trump. Second, import tariffs may improve the U.S. trade balance in the short term but significantly damage it in the long term. In simple terms, if a trade partner constantly imposes conditions, threatens, and pressures you, wouldn't it be better to seek alternative markets? And if that's not possible, isn't it obvious that countries will begin treating the U.S. the same way the U.S. treats them? The American economy is already showing signs of slowing, although the most recent GDP data (from Q4) is unrelated to Trump's policies. Still, many experts believe that further economic slowdown is inevitable. In other words, Trump's policies could push the U.S. economy into a recession—something even the Federal Reserve failed to do with its ultra-high interest rates. Yet Trump might succeed.

At this stage, the dollar's decline still appears to be a correction. However, if the market entirely withdraws investments from the U.S. economy and abandons the dollar due to Trump, the global 16-year trend could reverse by 180 degrees.

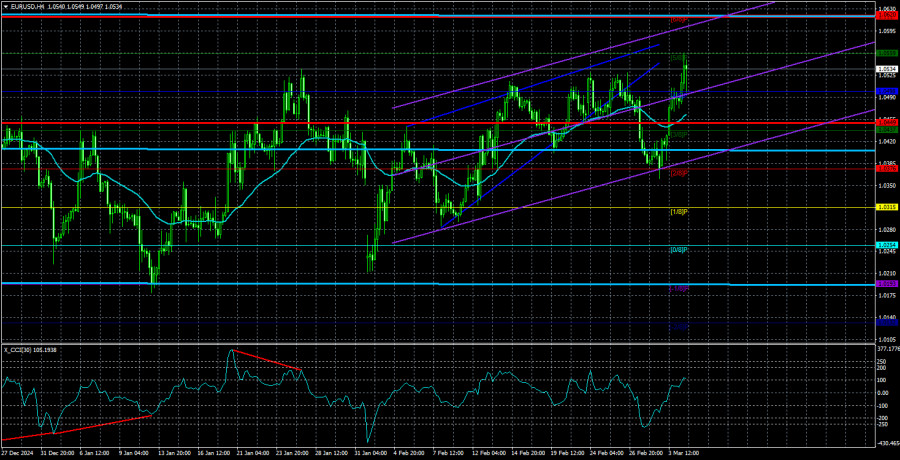

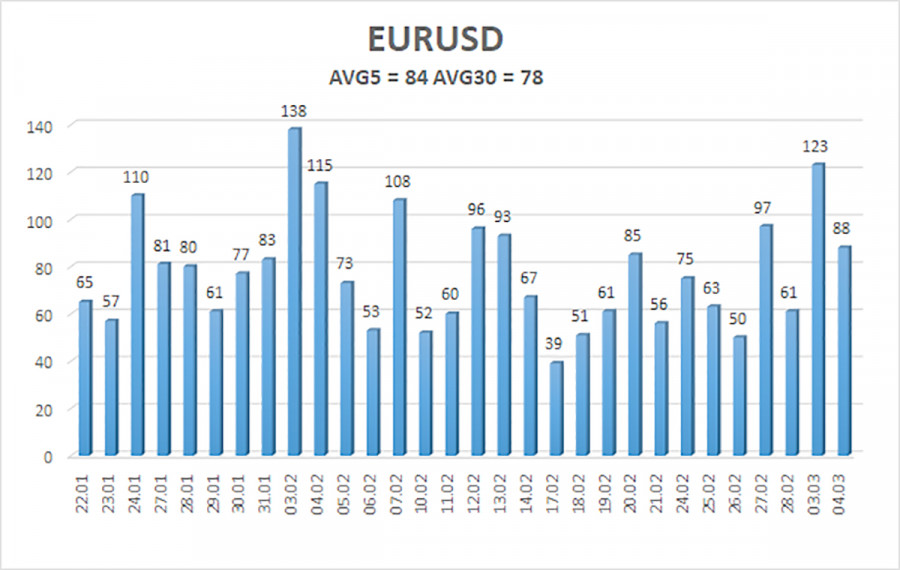

The average volatility of the EUR/USD currency pair over the past five trading days as of March 5 is 84 pips, which is classified as "average." We expect the pair to move between 1.0449 and 1.0617 on Wednesday. The long-term regression channel has turned sideways, but the overall downward trend remains intact even if it turns upward. The CCI indicator has again entered the oversold zone, signaling another wave of upward correction.

Nearest Support Levels:

S1 – 1.0498

S2 – 1.0437

S3 – 1.0376

Nearest Resistance Levels:

R1 – 1.0559

R2 – 1.0620

R3 – 1.0681

Trading Recommendations:

The EUR/USD pair continues to trade within the sideways channel of 1.0220–1.0520. For months, we have consistently stated that we expect the euro to decline in the medium term, and nothing has changed. The dollar still has no fundamental reasons for a medium-term decline—except for Donald Trump. Short positions remain much more attractive, with initial targets at 1.0315 and 1.0254, but a fresh breakout below the moving average is needed. If you trade purely on technical analysis, long positions could be considered if the price is above the moving average, targeting 1.0559 and 1.0681. However, as we can see, the price has struggled to break out of its range on the daily timeframe. Any upward movement is still classified as a correction on the daily chart.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.