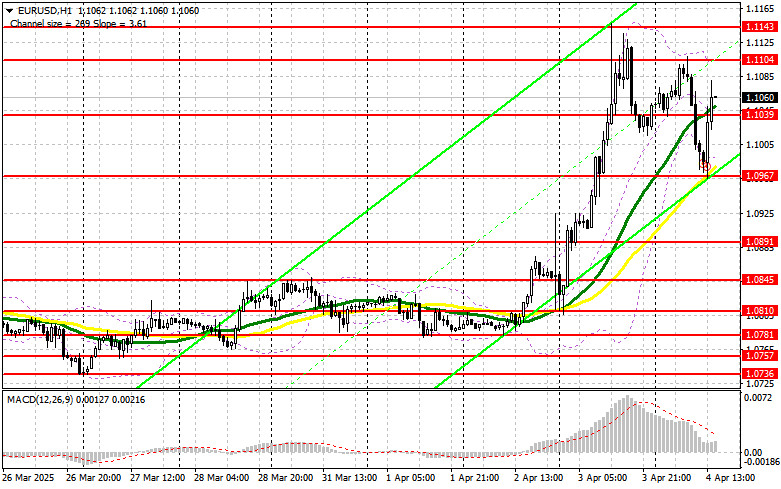

In my morning forecast, I highlighted the 1.0994 level and planned to base my market entry decisions on it. Let's look at the 5-minute chart and break down what happened there. A decline followed by a false breakout at that level provided an excellent entry point for long positions, resulting in a 50-point rally in the euro. The technical outlook was revised for the second half of the day.

To Open Long Positions on EUR/USD:

The euro posted a decent correction against the U.S. dollar, which large players quickly took advantage of by increasing their long positions ahead of key U.S. economic data. Two important reports lie ahead: nonfarm payrolls for March and the unemployment rate. These will determine the pair's direction.

Later in the U.S. session, Fed Chair Jerome Powell will speak and is expected to comment on the recently imposed U.S. tariffs on key trading partners, which could spark volatility in the U.S. dollar.

If the euro declines after the data release, a false breakout around the 1.1039 support will be a signal to buy EUR/USD, aiming for a bullish continuation toward 1.1104. A breakout and retest of that range from above would confirm the correct entry point for long positions, with targets at 1.1143, and the final target at 1.1179, where I will take profits.

In the scenario where EUR/USD falls and there is no buying activity near 1.1039, pressure on the euro will intensify. In this case, sellers may push the pair down to 1.0967. Only after a false breakout forms there will I consider buying. I also plan to open long positions on a rebound from 1.0891, targeting a 30–35 point intraday correction.

To Open Short Positions on EUR/USD:

Sellers tried in the first half of the day, and with some success, but failed to hold their ground. Now the outlook depends on strong U.S. data. If the reaction to the reports is negative, a false breakout at the 1.1104 resistance will offer a short entry point, targeting support at 1.1039. A breakout and consolidation below this level would be a good selling opportunity with further movement toward 1.0967, and the final target at 1.0891, where I will take profits.

If EUR/USD continues rising in the second half of the day—which seems more likely—and bears fail to act around 1.1104, I will postpone shorts until we test the next resistance at 1.1143, where I'll only sell after a failed consolidation. If there's no downward move even there, I'll consider shorts on a rebound from 1.1179, aiming for a 30–35 point pullback.

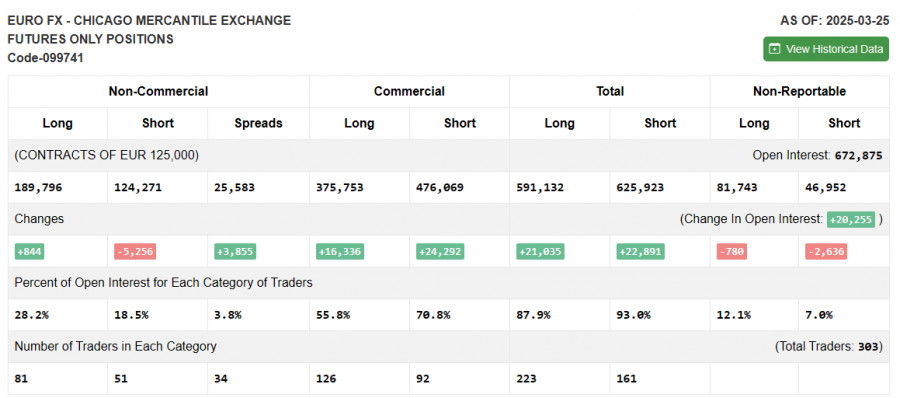

COT Report (Commitment of Traders) – March 25:

The COT report showed a slight increase in long positions and a rather sharp reduction in shorts. Interest in buying the euro is not rising significantly, but sellers continue to exit the market. Given the latest eurozone inflation data and ECB officials' comments, the central bank is likely to maintain its current stance at the April meeting, which could support the euro in the short term.

However, the extent to which U.S. tariffs impact other countries will be critical. The greater the perceived threat to global growth, the more pressure there will be on risk assets—including the euro. Long non-commercial positions rose by 844 to 189,796 and short non-commercial positions fell by 5,256 to 124,271. The gap between longs and shorts widened by 3,855

Indicator Signals:

Moving Averages Trading is taking place above the 30- and 50-period moving averages, indicating a new bullish market for the euro.Note: The author uses H1 (hourly) charts to determine moving averages, which may differ from D1 (daily) chart readings.

Bollinger Bands In case of a decline, the lower band around 1.1000 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Smooths out price noise and shows trend direction. 50-period is yellow, 30-period is green.

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, Signal SMA – 9

- Bollinger Bands: Volatility bands around a 20-period moving average

- Non-commercial traders: Speculators (e.g., individual traders, hedge funds, institutions) who use the futures market for speculative purposes

- Long non-commercial positions: Total long open positions held by non-commercial traders

- Short non-commercial positions: Total short open positions held by non-commercial traders

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.