Analysis of Tuesday's Trades

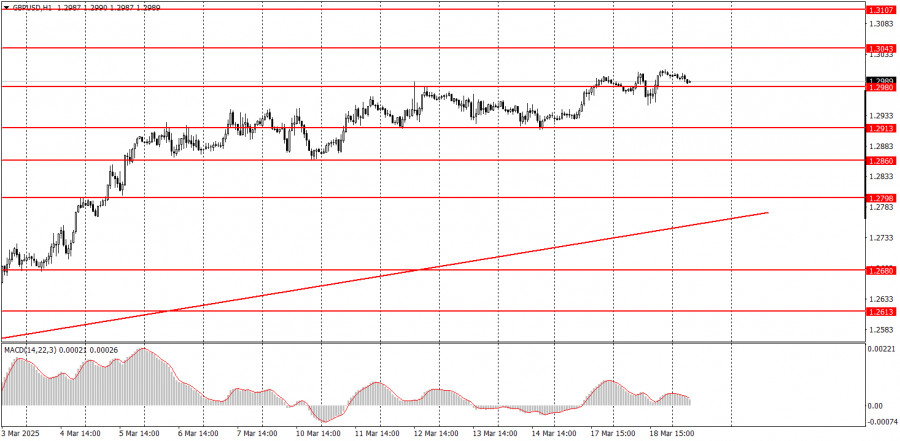

1H Chart of GBP/USD

On Tuesday, the GBP/USD pair closely mirrored the movements of the EUR/USD pair. The British pound often follows the euro, and on some occasions, it simply replicates its movements. Yesterday, the euro traded in a highly technical manner, allowing traders to open two profitable trades. However, the pound, while mirroring the euro's actions, applied those movements to its own price levels, which were not identical to those of the euro.

Overall, the British pound continues to rise, despite various factors at play. There were no significant events or reports in the UK on Tuesday, although U.S. reports provided support for the dollar. By the end of the day, however, the pound had risen again—though not significantly. This slow and steady increase has been its recent trend. The market remains hesitant but continues to sell off the U.S. dollar, likely due to the lack of daily tariff announcements from Donald Trump. The uptrend in the pound is clearly visible.

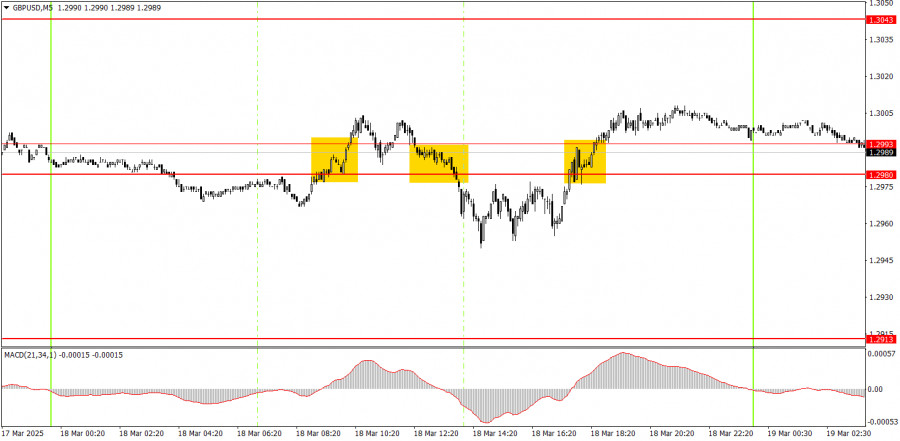

5M Chart of GBP/USD

On the 5-minute timeframe, three trading signals were generated on Tuesday, all of which turned out to be false. However, the second short trade could have been closed at breakeven, as the price moved 20 pips in the right direction. The third trade could have even resulted in a small profit if it had been closed manually in the evening.

Trading Strategy for Wednesday:

On the hourly timeframe, the GBP/USD pair should have started a downtrend long ago, but Trump is doing everything to prevent it. In the medium term, we still expect the pound to decline to 1.1800, but it is unclear how long the dollar's decline will last due to Trump's influence. Once this movement ends, the technical picture across all timeframes could change dramatically. For now, long-term trends still point downward. The pound's recent rise was not entirely unjustified, but it was once again excessive and illogical.

On Wednesday, the GBP/USD pair may continue rising as the market no longer needs any fundamental justification to sell the dollar. However, today's Federal Reserve meeting could bring volatility and erratic movements in the evening.

On the 5-minute timeframe, key levels to trade around are 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2613, 1.2680-1.2685, 1.2723, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043, and 1.3102-1.3107. No significant events or reports are scheduled for the UK on Wednesday, while in the U.S., the Federal Reserve meeting results will be announced. The dollar is unlikely to receive strong support from the Fed, and market movements could be turbulent.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.